As the global economy is a shaky rollercoaster right now, Dubai’s real estate market seems to be relaxing. Against all odds and despite a few economic bumps elsewhere, Dubai’s property market is flexing its muscles in Q1 2025 with a jaw-dropping 23% surge in residential transactions, proving once again that this desert city knows how to turn sand into precious gold.

Let’s have a recap of what’s happening in the market, why everyone from investors to expats is rushing in, and why Q1 2025 might just be the start of Dubai’s next real estate golden age.

Dubai’s Q1 2025 Real Estate Snapshot

While global economies tap the brakes, Dubai hit the gas. According to a recent report by the Dubai Land Department, Dubai clocked a staggering 42,274 transactions in just three months, spanning both secondary (ready) homes and off-plan properties. Yes, that’s almost one transaction every minute.

But here’s the main game: while the quarter-on-quarter numbers dipped 10%, we’re looking at a 23% increase year-over-year. Which means that momentum is still strong, and despite whispers of market stabilization, demand hasn’t gone anywhere.

Off-Plan market is On Fire: 59% of All Transactions

If there were a “Dubai Property Popularity Contest,” off-plan homes would be the highest achieving sector. 59% of all transactions in Q1 were off-plan. And developers are busy sketching, designing, and selling properties faster than you can say “handover date.”

This isn’t just a craze; it’s a strategic shift. Buyers are playing the long game, snapping up future homes at current prices. A smart hedge against rising market values. Investors seem to be moving away from speculative flipping and opting for long-term, sustainable gains. Smart, savvy, and still stylish.

Luxury Market Is a Beast: Prices Jump, Records Are Broken

If you thought luxury in Dubai meant Rolls-Royce-clad Instagram posts and infinity pools on the 50th floor, you’re not wrong, but the real estate market just turned the volume up to eleven.

The ultra-luxury segment (AED 20M and above) saw the highest surge in transactional activity, with communities like Emirates Hills leading with a 101% price rise. That’s not a typo, one hundred and one percent.

And right into the footprints, Jumeirah Islands with a 52% increase. We’re officially seeing a renaissance in the villa sector.

Even more impressively, 19 out of 20 villa/townhouse communities tracked saw rising prices, averaging a 23% climb. If you’ve been sitting on a villa in Dubai, congratulations! You’ve basically been living in an appreciating goldmine.

Apartments Join the Party, But bit Slow

Not to be outshined, apartment communities also had their moment. Prices rose in all 11 tracked areas, with The Views area taking the crown at a 17% increase. The average rise across apartments stood at a modest but healthy 10%.

While not as dramatic as villas, this segment signals steady demand, particularly from first-time buyers and long-term residents looking to swap rent payments for mortgage installments.

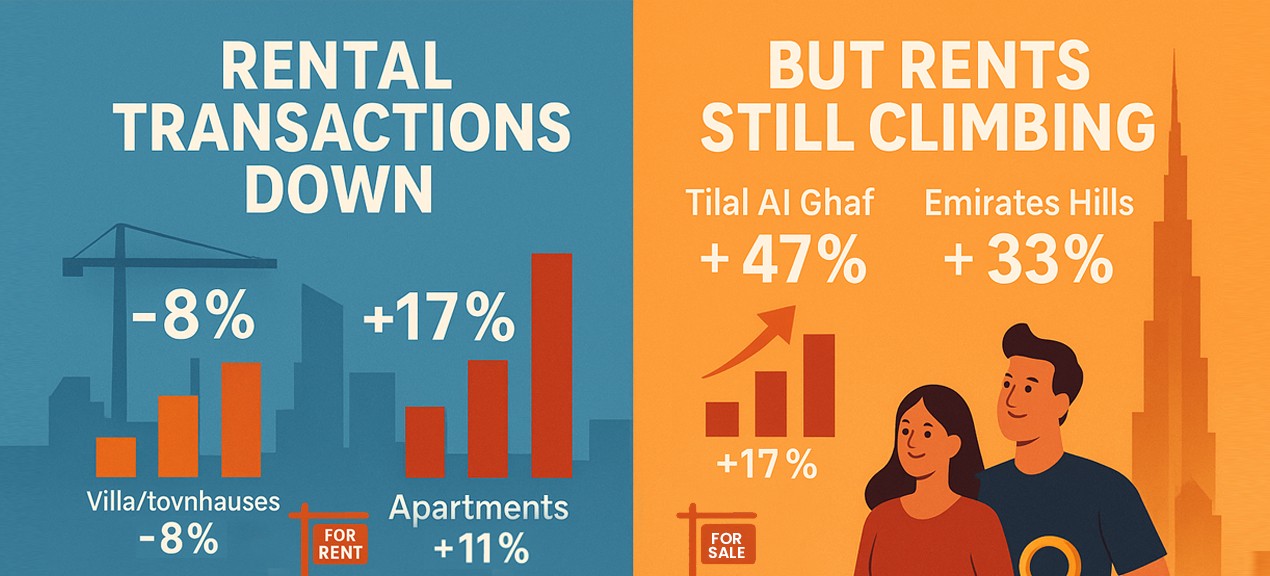

Rental Market Slightly Drops, But Prices Are Still Rising

Here’s the Dubai rental market’s paradox: transactions are down, but rents are up. How? It’s all about the Dubai property enigma.

- Villa/townhouse rentals dropped 8% compared to Q1 2024.

- Apartment rentals dropped 17%.

- But rents rose 19% and 11%, respectively.

Communities like Tilal Al Ghaf (+47%) and Emirates Hills (+33%) are seeing especially aggressive rent increases. In short, people are opting to buy instead of rent. And this is a clear sign that Dubai is transitioning into a more ownership-focused market.

Buyers Are Coming from Everywhere

To this day, Dubai remains highly appealing to a global audience. And the numbers back it up. We’re seeing a sharp diversification of buyer nationalities, with more interest coming in from Eastern Europe and the usual Western European influx.

This isn’t just a fun fact; it’s a powerful signal that Dubai is solidifying its global real estate reputation with safety, tax efficiency, world-class infrastructure, and sustainability.

Now for a twist. While transactions and demand are up, unit completions are down by 15% compared to the same time last year.

That might sound alarming, but it’s actually a sign of healthy deceleration. Slowing supply means developers are likely being more strategic, which can lead to more sustainable growth instead of a chaotic boom-and-bust cycle.

As always, Dubai seems to be playing chess while others are playing checkers.

Key Takeaways: Why Q1 of 2025 Is Becoming a Big Deal

If we see closely the insights, we will not be surprised by the market:

- Transaction Volume Up: +23% YoY despite global instability.

- Luxury Leads: Emirates Hills is up 101%, and villas outperform apartments.

- Off-Plan Dominates: 59% of all Q1 deals.

- Ownership Surge: Decline in rentals, rise in buying.

- Global Appeal Rising: Buyer base becoming more diverse.

- Supply Tightens: 15% fewer units completed, clearly stating long-term price support.

Dubai Real Estate Is Still a Power Play

If you’re thinking about entering Dubai’s real estate market, Q1 2025 just sent a very clear message: the door of appreciation is wide open. But it may not stay that way forever.

With steady demand, rising prices, strategic supply, and a globally diversified buyer pool, the Dubai market is anything but not boring. Whether you’re an investor, a first-time buyer, or someone who just loves tracking property trends like their football scores, keep your eye on Dubai.

Because in this city, real estate seems to keep zipping forward in style even when the world zigzags. For better insights and the latest updates, follow our website.